Department of Home Affairs data matching program with Australian Tax Office to crackdown on temporary skilled employer-sponsored visas.

‘Big brother is watching you’ – no we are not talking about the first of its kind reality TV series popular in over 100 countries. We are referring to the phrase coined by George Orwell in the first chapter of his novel 1984. The phrase succinctly reflects government surveillance on individuals through use of devices, technology and alliances.

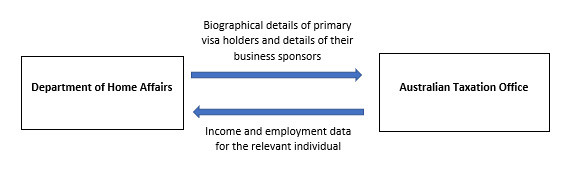

With reference to the latter, as of a few short months ago the Department of Home Affairs (‘the Department’) has teamed up with the Australian Taxation Office (‘ATO’) on a new data matching program and now we suspect that what once was a phrase in a fiction novel has evolved into a present-day reality, one that is kind of scary we have to admit.

Authority to collect, use and disclose information

The Department are an enforcement body for the purposes of the Privacy Act and as an enforcement body, they have the jurisdiction to collect, use and disclose personal information where it is reasonably necessary for, or directly related to, one or more enforcement related activities conducted by the Department or on behalf of the Department.

Prior to 1 July 2017, the Department and the ATO dabbled in data and information sharing for the purpose of locating individuals who are unlawful in Australia. The information swap would include the Department providing biographical and identifying information such as name and date of birth to the ATO in exchange for address details in order to locate individuals who has been classified as ‘illegal non-citizens.’ It was in this way the ATO played a hand in completing a non – compliance order sanction.

Recently, the Department have announced that they will engage in a data-matching program with the ATO to obtain specific information about temporary skilled visa holders and their sponsors to identify fraud and ensure that visa holders, their sponsors and migration agents are meeting their visa, tax and superannuation obligations.

Between 1 July 2017 and 30 June 2020, the records of 20 million visa holders and their sponsors, educators and migration agents will be put under the microscope by the Department’s data matching program.

The Department will exchange data with the ATO to identify the following:

- Whether business sponsors are complying with their Sponsorship obligations – e.g. paying visa holders correctly;

- Temporary skilled visa holders are complying with their visa conditions – e.g. to work only for an approved employer and to work only in the approved occupation.

Sources of third-party information

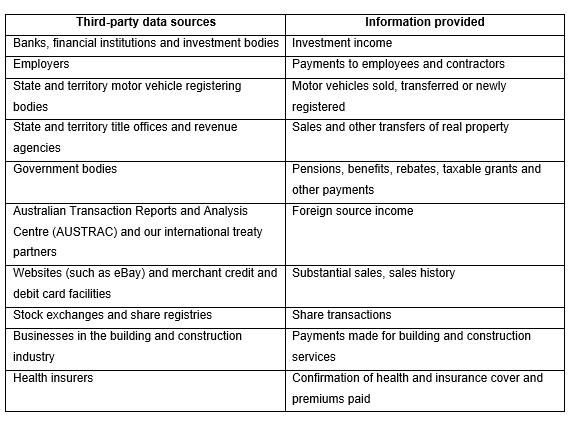

The ATO collects information from a wide range of third-party sources, both public and private, with more than 600 million transactions reported to the ATO annually.

The table below are examples of third-party sources and the information provided to the ATO which can be exchanged with the Department.

What does it mean for visa holders?

The Department and ATO sympathise with the possibility that some visa holders may not have a clear idea of their obligations under Australian law or alternately fail to recognise where they have compromised their obligations. Further the two bodies accept that there will be cases where information from their end is compromised and perhaps not an accurate reflection of the current situation.

As such, prior to any administrative action being undertaken, the ATO will provide a notification to individuals via telephone, letter or e-mail, in the case of information discrepancy and provide the individual 28 days to verify the accuracy of the information that has been derived from the data matching program.

However the ATO states that prosecution action may be initiated where appropriate. If the individual does not agree with an assessment, they have the legal right to appeal against those decisions through tribunals and the courts.

Where it is found that an individual has failed to comply with their obligations, even after being notified, the Department will take administrative action. Administrative action for non-compliance may include visa cancellations, refusals and possible bars.

What does it mean for their sponsors?

Where there is a discrepancy, it can be expected that the Department will be taking a keen interest and may monitor the activities of the business such as impromptu site visits. If a sponsor is found to have breached their obligations, sanctions may apply depending on the severity.

The Department may take administrative action to:

- bar you from sponsoring additional visa holders for a specified time;

- refuse your application for sponsorship for this or any other visa; and/or

- cancel all current and existing sponsorship approval.

Civil action may also be taken against the sponsor to:

- issue an infringement notice of up to AUD12,600 for a body corporate and AUD2,520 for an individual for each failure;

- apply to a court for a civil penalty order of up to AUD63,000 for a corporation and AUD12,600 for an individual for each failure.

What now?

In Orwell’s dystopian Oceania, technology more than any other tool was their greatest weapon in attracting authority. Drawing a parallel here, it is not far-fetched to say that the same rings true for our own Government in its fight to ensure compliancy.

And all of this is dependent on one key variable: access. In 1984’s Oceania, technology fostered access via telescreens and clandestine microphones which diluted privacy and promulgated surveillance. Here in the real world the Department has garnered access via data and information sharing with its partner the ATO.

With this new program in place between the Department and the ATO, it is likely that a consequence will be an increase in the number of visa refusals and cancellations.

To avoid this stress, visa holders must take care and appropriate steps to ensure they are meeting all the conditions of their visa and abiding by Australian tax law. In a similar vein, sponsors must be more diligent than ever to ensure that they are compliant when hiring temporary visa holders.

If you would like to discuss steps to monitor and ensure compliance feel free to chat to one of our consultants via info@giltonvaleo.com.au.

For more information on the program, check out the published protocol prepared by the Department in collaboration with the ATO available via the Department’s website.