Let’s talk about on-hire labour!

This one is for our recruitment clients, particularly in healthcare, technology and construction!

Why on-hire labour?

Because assigning foreign workers to third-party employers is only possible via on-hire labour agreements, meaning that recruitment firms, IT consulting or any other staffing companies that are typically better equipped to source, recruit, place, and retain international talent, can now do the leg work of FINDING talent and Australian employers can hire that talent without having to search for them!

Indeed, with the Australian domestic labour market clearly lacking and unlikely to improve soon, looking overseas is becoming more and more common these days, especially within the healthcare, technology, construction and hospitality industries.

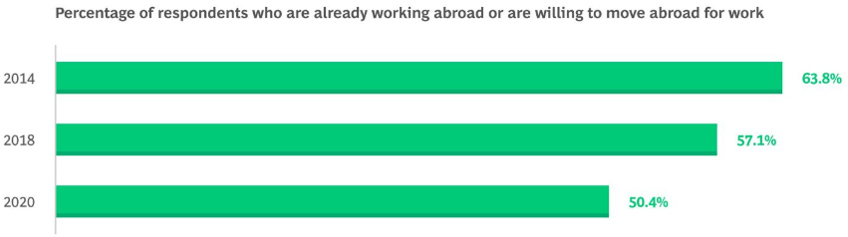

According to a recent Boston Consulting Group report, it appears that the willingness of talent to relocate has decreased over the last decade. In fact, the percentage of respondents (over 208,000 surveyed) willing to work abroad (or already abroad) has fallen to just 50% which represents a significant reduction in the available talent pool.

Now coupled with the backlog in global visa processing, and the hangover from the pandemic, Australia (like much of the world) is facing fierce competition for talent at all levels.

And this is where forward planning, diligence and talent retention strategies come into play.

Many local employers simply do not have the means to source, recruit, place and retain talent and this is where the opportunity lies for many recruitment agencies in industry-specific occupations.

Given the significance of shortages in healthcare, technology, construction and hospitality, it may be time that your recruitment business considers this as a tool for business growth (and survival).

What does this mean for recruitment/staffing firms?

On-hire labour agreements enable the recruitment, staffing and consultancy industry to actively position itself as a conduit to the vastly growing awareness that a company’s next best hire is likely to be overseas.

And so on-hire labour agreements could be lucrative for recruitment agencies that are experienced at finding and bringing over skilled workers, and more effective for employers too.

The fine print!

An On-Hire Labour Agreement allows your business to recruit temporary skilled overseas workers to occupations on the Skilled Occupations List where you can demonstrate that there is no appropriately qualified Australian worker readily available. A business that enters into an on-hire labour agreement becomes an approved sponsor and is able to nominate and recruit overseas workers in the approved occupations.

As an approved sponsor with an on-hire business, your overseas workers can be assigned to work at a third party. However, you must remain the direct employer of all overseas workers sponsored under an on-hire industry labour agreement, and overseas workers must receive their salary on a regular basis in line with how equivalent Australians are paid, regardless of an assignment.

The On-Hire Labour Agreement is an industry agreement, meaning the terms and conditions of the agreement have already been established and are non-negotiable.

Hiring an overseas worker in Australia normally requires the employing organisation to hold a Standard Business Sponsorship (SBS). The On-Hire Labour Agreement allows an organisation to bypass the SBS (essentially deferring it to another party) and still gain access to the TSS visa program.

Definition of ‘on-hire’

For the purposes of an On-Hire Industry Labour Agreement, ‘on-hire’ means a person’s business activities which include activities relating to either or both of:

- the recruitment of labour for supply to another business; and

- the hiring of labour to another business.

IT CAN BE A GREY AREA!

A business provides labour hire services if both of the following are met:

- in the course of conducting business, the business supplies one or more individuals to another person/business (host) to perform work in, and as part of, the host’s business or undertaking

- the individuals are ‘workers’ for the provider.

An individual is a ‘worker’ for a provider where the arrangement between the host and the provider involves the provider supplying the individual to the host to perform work and, in this arrangement, the provider is obliged to pay the individual for the performance of that work, whether directly or indirectly through one or more intermediaries.

Contractors and independent contractors

One of the major tests when it comes to on-hire is determining whether you in fact are utilising an on-hire or contractor arrangement. Whether the test applies to a business utilising contractor arrangements, will depend on the manner in which the contractor is engaged by the business to perform the services. In circumstances where an independent contractor is engaged directly by a business as an individual contractor to perform services, an On-Hire Industry Labour Agreement will not be required, and an SBS will be the correct arrangement. This is because the contractor is not supplying workers to the business but is in fact supplying their own services directly to the business.

The general premise is that there is an obligation for one person to perform work (the employee) and for the other person to pay for that work (the employer). The fundamental consideration is the relationship between the parties when determining if a person is an employee (or sponsored employee), or an independent contractor.

Applying the test/definition of ‘on-hire’

The Fair Work Ombudsman has provided the below table to illustrate how ‘on-hire’ arrangements can work.

The table can provide a framework for us to assist you in reviewing existing contractual arrangements, to ensure the clauses reflect the intention of the arrangements and parties.

INDICATOR

EMPLOYEE

INDEPENDENT CONTRACTOR

Intention of the parties

The parties’ intention is to create an employment relationship. This intention could be shown by the worker providing a tax file number (TFN) and signing an employment contract.

For example, the worker responds to a job ad for a casual cleaner. The worker attends a job interview and is given an offer letter. The worker is also required to complete onboarding paperwork including a TFN declaration form, employment contract and superannuation form.

The parties’ intention is for the worker to be engaged as an independent contractor. This intention could be shown by the worker providing an Australian business number (ABN) and signing an independent contractor agreement.

For example, a worker responds to an ad seeking cleaning services. The worker negotiates the terms of an independent contractor agreement, and invoices (which include the worker’s ABN) are issued by the worker for cleaning services provided.

Able to delegate or subcontract work

Is required to complete the work themselves. For example, they can’t ask someone else to go to their workplace and do their work for them.

Can delegate or subcontract the services to be performed to another person or business.

Amount of control over how work is performed

Performs work under the direction and control of their employer on an ongoing basis. Work is controlled by the employer including hours, work location and how work is done.

For example, a shop assistant who is required to follow their manager’s instructions about how to serve customers, display clothes and when to tidy the change rooms.

For example, a gardener who attends sites at the times directed by their boss and is told to mow the lawns in a particular way.

Has a high level of control over the work they perform, their hours, work location and how they do the work.

For example, a tailor who collects garments from clothing stores for alterations when it suits their schedule, makes alterations in the way they choose and works from their own premises.

For example, a gardener who chooses their preferred suppliers and decides how and when to provide the landscaping services.

Financial responsibility and risk

Bears no financial risk (as this is the responsibility of their employer).

For example, a baker who gets paid their regular daily wage even if the bakery doesn’t make a profit for that day. The employer bears the loss of the unsold baked goods.

For example, a painter who spends a day painting a house, but still gets paid by the employer for the work performed, even if the home owner has not yet paid the employer.

Bears the risk for making a profit or loss on each task. Usually is personally responsible and liable for poor work or any injury sustained while performing the task. As such, contractors generally have their own insurance policy.

For example, a baker who supplies various baked goods to cafes but burns their croissants one day and can’t charge the cafes for the burnt croissants.

For example, a painter who paints a house in the wrong colour and doesn’t get paid by the client for the time and money spent.

Tools and equipment

Tools and equipment are generally provided by the employer, or a tool allowance is provided.

For example, an office worker who has their computer provided for them.

For example, a cleaner who uses cleaning supplies provided by the employer.

Uses their own tools and equipment (note: alternative arrangements may be made within a contract for services).

For example, an auditor who brings their own computer to do their work.

Hours of work

Generally, works standard or set hours (unless they’re a casual employee, in which case their hours may vary from week to week).

For example, a person who works regular 5 hour shifts twice a week at a petrol station.

By agreement between both parties, decides what hours to work to complete the specific task.

For example, a graphic designer who negotiates the cost of creating a logo based on how long it will take, and decides when they will do the work.

Expectation of work continuing

Usually has an ongoing expectation of work (note: some employees may be engaged for a specific task or specific period or on a casual basis).

For example, a worker in a pet shop who works on a part-time basis, 4 times a week on an ongoing basis.

Usually engaged for a specific task.

For example, a removalist who does a one-off house move for a customer.

Tax

Income tax is deducted by their employer.

Pays their own tax and GST (if applicable) to the Australian Taxation Office.

Superannuation

Entitled to have superannuation contributions paid into a nominated superannuation fund by their employer.

Pays their own superannuation (note: in some circumstances independent contractors may be entitled to be paid superannuation contributions).

Leave

Entitled to receive paid leave (for example, annual leave, personal/carers’ leave, long service leave) or receive a loading in lieu of leave entitlements in the case of casual employees.

Doesn’t receive paid leave.

Final thoughts

The on-hire labour agreement presents an opportunity for growth in a landscape where the domestic labour market is clearly lacking. With projects being put on hold, resources stretched to their limits and a general lethargy within the existing talent pool may lead to diminishing commercial sentiment and could invariably slide industries into further hardship.

The on-hire labour agreement enables the recruitment industry to actively position itself as a conduit to the vastly growing awareness that the next hire is likely to be overseas.

Gilton Valeo can answer your questions about Australia’s immigration system

As experts in Australian immigration, Gilton Valeo can guide you in identifying the best immigration pathways to bring people over to start your Australian office, provide you with strategic consulting along the way, and connect you with our partners to make sure everything goes smoothly.

Check out everything we offer on our website, or connect with us on Facebook, Instagram, LinkedIn, or Twitter!