The immigration department has recently given advance notification of forthcoming changes to immigration law and policy.

Subclass 457 changes – Changes from 19 November 2016

Condition 8107

When a subclass 457 visa is granted, the visa holder is automatically subject to a condition known as Condition 8107. Previously, the condition 8107 allowed a primary subclass 457 visa holder to remain unemployed in Australia after their employment ceases for a period of 90 consecutive days. This rule meant that if a subclass 457 visa holder leave their employer, they will have 90 days to become sponsored by another employer or their visa can be cancelled.

Strictly speaking, a subclass 457 visa holder cannot wait until the 90th day for the new employer to lodge a new nomination application because the clock does not stop when the nomination application is lodged. Under the regulation, the period during which the holder ceases employment must not exceed 90 consecutive days – meaning that the clock only stops when the new nomination application is approved, or they risk visa cancellation.

From 19 November 2016, the period that a primary subclass 457 visa holder can remain in Australia after their employment ceases will be reduced from 90 days to 60 days. This change would apply to all subclass 457 visas from 19 November 2016.

The regulation now provides:

8107 3(b) if the holder ceases employment – the period during which the holder ceases employment must not exceed 60 consecutive days.

This effect of change is that if a subclass 457 visa holder loses their job, they will only have 60 days to locate a new employer and obtain a nomination approval. As some may know, job search and interviews can take more than 60 days, and this does not include the DIBP’s current standard processing time of 40 working days (about 56 calendar days) for nomination applications.

This policy will make it practically impossible for subclass 457 visa holders to find a new position and to stay in Australia if they lose their job.

Definition of ‘member of family unit’

The definition of ‘member of family unit’ will become harder for permanent and most temporary visa application as of 19 November 2016. The ‘members of the family unit’ definition is now limited to:

• the spouse or de facto partner of a primary applicant, and

• children of the primary applicant or their partner, who are dependent. Children (including step-children) can no longer be included in the visa application if they are over the age of 23 (unless they are incapacitated for work).

This amendment also removes the provision for family members outside the nuclear family from being included in the family unit. That is, relatives (including siblings and dependent parents) cannot be included in permanent visa applications and most temporary visa applications (refugee and humanitarian visas excluded).

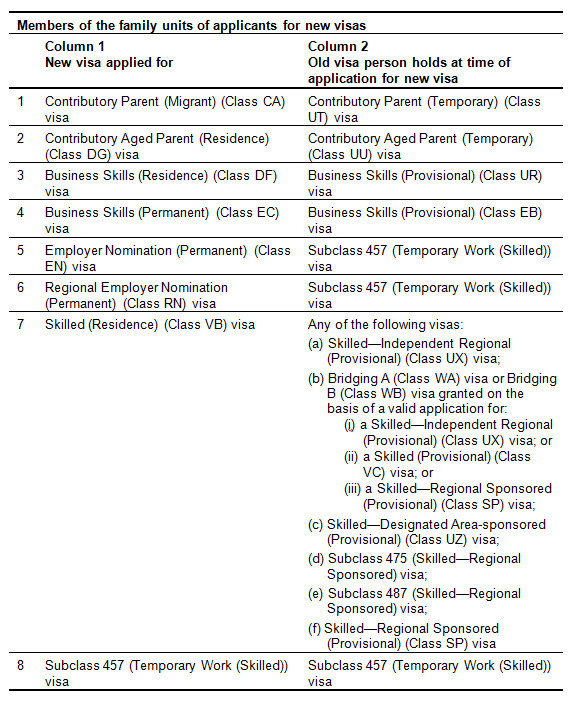

Although children over the age of 23 and relatives are not permitted to be included in the temporary visa applications, the amendments do allow a visa applicant’s previous status as a ‘member of the family unit’ to apply in a specific way for specified visa subclasses to ensure that family members are not disadvantaged due to the passage of time.

For example, a child (now 24) who was included as part of his/her parent’s temporary visa application when he/she was 16, will be permitted to include in his/her parent’s subsequent related visa application (where they would otherwise no longer be eligible).

This change would apply to subclass 457 visa applications made on, or after, 19 November 2016.

Work and Holiday

Changes as of 19 November 2016

As of 19 November 2016, work and holiday visa holders (Subclass 462) are eligible to stay for a second year working in Australia. Subclass 462 visa holders can apply for a second Subclass 462 visa if they have carried out specific work in regional Australia. The visa holders must carry out the work for at least three (3) months as a holder of the first Subclass 462 visa. These amendments are in line with the Government’s White Paper on ‘Developing Northern Australia’ where the specified work is intended to be work undertaken in the agriculture, forestry, fisheries, tourism and hospitality industries in Northern Territory and northern parts of Western Australia and Queensland. Currently the following 16 nations are able to participate in the Subclass 462 program:

- Argentina

- Bangladesh

- Chile

- China, People’s Republic of

- Indonesia

- Israel

- Malaysia

- Poland

- Portugal

- Slovak Republic

- Slovenia

- Spain

- Thailand

- Turkey

- USA

- Uruguay

Changes as of 1 January 2017

From the 1 January 2017:

- Applicants under the age of 35 years old can apply for a Working Holiday, or a Work and Holiday visa;

- There will be more flexible arrangements, allowing an employer with premises in different regions to retain employees for up to 12 months, providing the second six (6) months is in a different location;

- the Visa Application Charge for the Working Holiday Maker Visa applications will be reduced from A$420.00 to A$390.00 as 1 January 2017.

Tax Changes

Legislation is currently before Parliament to introduce a tax that will treat working holiday maker visa holders as non-resident for tax purposes. From 1 January 2017, working holiday visa holders cannot access the $18,200 tax-free threshold which is available to Australian residents. The tax rate for income less than $37,000 will be 19% (rather than the 32.5% announced in the 2015-2016 Budget).

The tax on working holiday visa holder’s superannuation when leaving Australia will be increased to the 95%, effective 1 July 2017. This effectively means working holiday makers will forfeit their superannuation on departing Australia.